This can help you better match your inventory levels with actual customer demand. A lower CCC signals that a business is able to convert its inventory and receivables into cash faster. This is a positive sign for cash flow management, meaning the business can then reinvest in more inventory or other growth initiatives. In this article, we’ll dive into what days inventory outstanding is, why it’s important to understand, measure, and track, and how to improve yours.

Why DIO is important for business

Each metric evaluates different aspects of your company’s efficiency and financial health. When assessing your operational efficiency, measuring DIO helps you monitor how well you manage inventory stock levels and cash flow. Fast inventory turnover often indicates a solid sales process, which is vital for maintaining profitability.

Tips for Improving DIO:

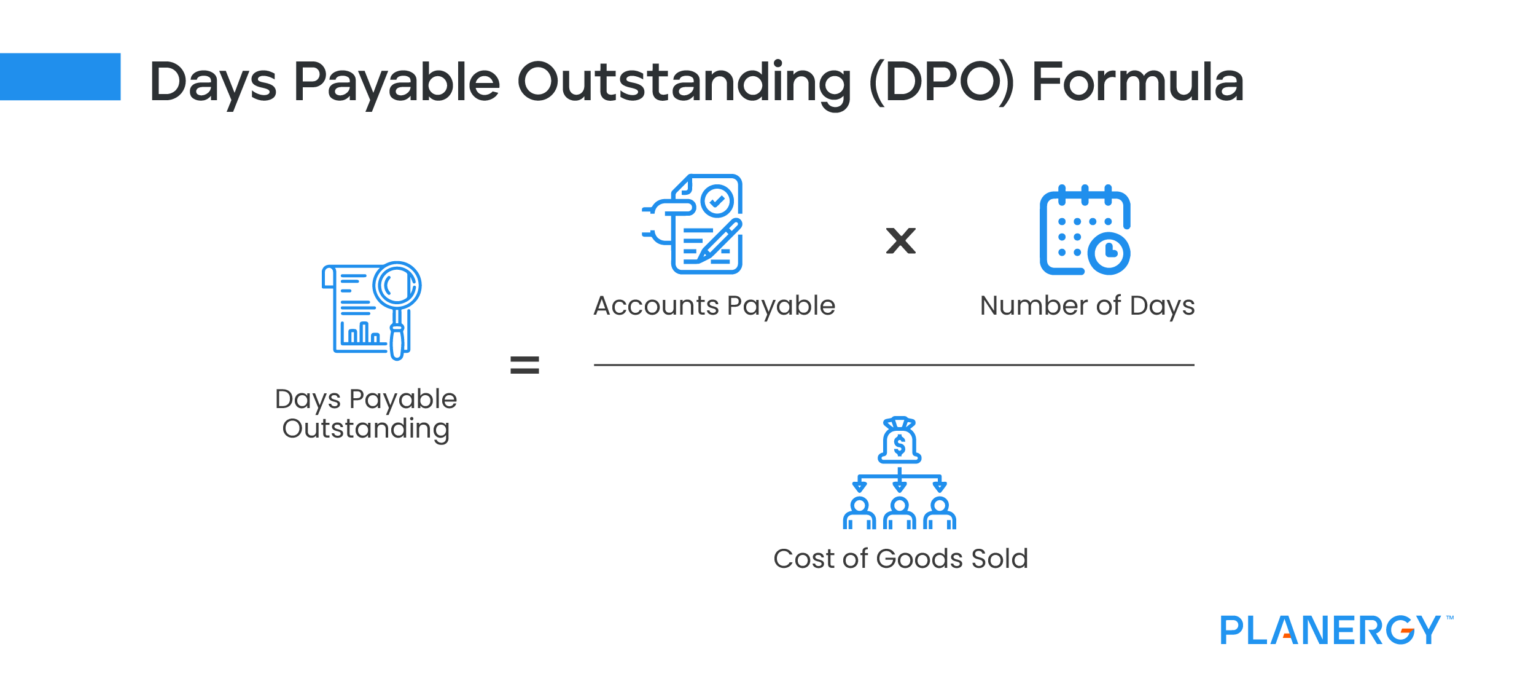

By understanding the factors that affect DIO and implementing strategies to improve it, businesses can make better decisions about their inventory management and achieve their financial goals. A high DIO indicates that a company is holding onto its inventory for too long, which can tie up cash flow and increase the risk of inventory obsolescence. On the other hand, a low DIO indicates that a company is selling its inventory quickly, which can free up cash flow and reduce the risk of inventory obsolescence. Days inventory outstanding (DIO) is a measure of how long it takes a company to sell its inventory. It’s calculated by dividing the average value of inventory by the cost of goods sold (COGS) and multiplying by the number of days in a year. Modern inventory management software automatically collects data and builds reports around key inventory metrics – including DIO.

- This generates revenue that can be put back into the business to pay for ongoing operations, and to invest in continued productivity and growth.

- Another factor that can affect DIO is the level of competition in the market.

- Calculate the average DIO to identify and gauge whether inventory is trending up or down.

Chief Investment Officer vs. Chief Financial Officer: Understanding the Key Differences

They can also measure the days components or raw materials are stored until they are pulled into production. The result indicates how efficient a company’s cash conversion cycle is. All companies that make or sell products can benefit from calculating DIO. The supply chain management should be proper and an effective and transparent communication is required to make the process to be smooth. In general, the higher the inventory turnover ratio, the better it is for the company, as it indicates a greater generation of sales. A smaller inventory and the same amount of sales will also result in high inventory turnover.

To be successful, it’s necessary for business owners to manage their inventory properly. However, if your DIO indicates that a business only turns over inventory twice a year, profitability will be directly affected, with fewer sales and less revenue. For example, if average days inventory outstanding your business is negotiating a large order from one of your best customers, you’ll likely order excess inventory to complete the order. The result shows that for the first quarter of 2023, your business is able to clear existing inventory every twenty-four days.

The connection to inventory turnover and operational efficiency

A business is considered efficient and profitable if according to the days inventory outstanding calculation, it is able to convert the inventory stock to cash within a very limited timeframe. It means that it has a strong selling network, efficient allocation of resource to carry on the task and is able to collect the money on time which can be invested further for growth and expansion. With this DIO calculator (days inventory outstanding), you can easily calculate the time it takes for a company for inventory turnover into sales. DIO is a very effective metric when analyzing the effectiveness of a company. One must also note that a high DSI value may be preferred at times depending on the market dynamics.

Next, the company’s days inventory outstanding (DIO) can be calculated by dividing the $20mm in inventory by the $100mm in COGS and multiplying that by 365 days – which results in 73 days. The average inventory turnover and DIO varies by industry; however, a higher inventory turnover and lower DIO is typically preferred as it implies the management of inventory is closer to an optimal state. In other words, DIO tells you how many days, on average, a company has its inventory sitting on the shelf before it’s sold. A lower DIO is generally better, because it means that the company is able to turn its inventory into cash more quickly.

In this case, our beginning inventory was $200,000 and our inventory was $300,00, giving us an average inventory of $250,000. However, the projected inventory balances are equivalent under both approaches, as confirmed by our completed model. Therefore, the company requires roughly ~73 days to clear out its inventory, on average. Unless the company operates in a highly seasonal industry with fluctuations in sales throughout the year, the difference between methodologies tends to be insignificant in most cases.

Suppose we’re tasked with measuring the operating efficiency of a company, which reported a cost of goods sold (COGS) of $100mm and an inventory balance of $20mm in 2020. Note that the average between the beginning and ending inventory balance can be used for both the calculation of inventory turnover and DIO. A comparative benchmarking analysis of a company’s inventory turnover and DIO relative to its industry peers provides useful insights into how well inventory is being managed.

Offering discounts or promotions can help clear out aging stock, freeing up space and reducing the risk of obsolescence. Building strong supplier relationships can also lead to more reliable delivery schedules and better supply chain visibility, further optimizing backlog turnover. In today’s fast-paced environment, stock-outs and supplier delays can severely disrupt business operations.

If you’ve got good-quality data (you’re using an inventory system that pulls the correct inventory metrics), it’s fast and easy to find your Days Inventory Outstanding rate. Improving your Days Inventory Outstanding rate enables your business to reduce storage costs and improve overall inventory efficiency. Try to identify what might be causing the improvements in your inventory management efficiency and double down on them.